Sarah’s life changed a lot when her father passed away. He left her a house with a foreclosure threat. She felt overwhelmed by grief and money worries. That’s when Sell My House Rocket Fast helped her out.

They guided her through the foreclosure process. They showed her what she could do with the house. Thanks to their help, Sarah stopped the foreclosure and made a smart choice about her father’s house.

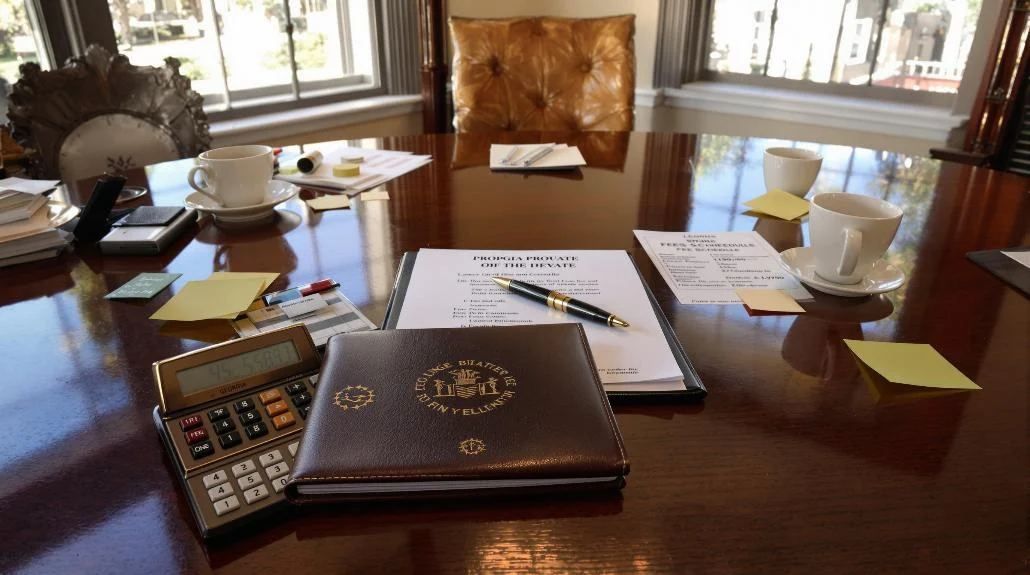

Getting a property from an inheritance can be tricky, especially if it has a mortgage or is facing foreclosure. The probate court and dealing with lenders can be hard. But, there are ways to stop foreclosure and protect your property. Let’s look at some strategies to help you avoid foreclosure and use your inheritance wisely.

Key Takeaways

- Act quickly to communicate with the mortgage lender about the inherited property

- Understand the role of probate court in the inheritance process

- Explore options like refinancing or loan modification to stop foreclosure

- Consider selling the inherited property if maintaining it isn’t feasible

- Seek advice from a foreclosure attorney to navigate your options

- Gather all necessary documentation related to the inherited property

- Be aware of how debts carry over in property inheritance

Understanding Inherited Property in Foreclosure

Inheriting property can be complex, especially when it’s in foreclosure. Let’s explore what happens when you inherit property facing foreclosure proceedings and how the probate process impacts this situation.

Inheriting a Property in Foreclosure

When you inherit property in foreclosure, the mortgage company must include you in legal proceedings. This is true if you’re an heir, estate executor, or administrator. You’ll get updates on the foreclosure status and any actions that will happen.

Probate Court’s Role

The probate process is key in handling inherited property. Probate court decides how the deceased person’s estate is split and pays off debts. The court might also name an executor to handle the estate’s matters.

Debt Transfer in Property Inheritance

You don’t automatically get the deceased’s debts when you inherit property. But, the property could still face foreclosure if mortgage payments aren’t made. The estate executor must settle the deceased’s debts with creditors.

“Inheriting property doesn’t mean inheriting debt, but the property itself may still be at risk.”

A transfer on death instrument can make inheriting property easier. It can skip probate in some cases. This legal tool lets property go directly to beneficiaries when the owner dies. It might help speed up dealing with foreclosure issues.

Communicating with the Mortgage Lender

When you inherit a property in foreclosure, you must act fast. Your first move should be to contact the mortgage lender. This can greatly help in saving the property.

Prompt Lender Notification

Reach out to the lender as soon as you know about the inheritance. This shows you’re serious about fixing the issue. Tell them you’re now in charge of the property and you want to talk about your options.

Necessary Documentation

Before you talk to the lender, collect all important papers. You’ll need the death certificate, will, and any papers from probate court. Also, have proof of your link to the deceased and your right to inherit.

Exploring Lender Options

Lenders may have programs to prevent foreclosure. Ask about loan changes that could lower your payments or extend your loan. If the property’s value is low, a short sale might be an option. Sometimes, a deed in lieu of foreclosure is the best choice.

“Many lenders are willing to work with inheritors to find solutions. Don’t be afraid to ask questions and explore all available options.”

Remember, foreclosure laws change by state. It’s smart to learn about the laws in your area. By doing this, you boost your chances of getting a good deal with the lender. This could help save the inherited property from foreclosure.

Legal Options to Stop Foreclosure on Inherited Property

Facing foreclosure on inherited property can feel overwhelming. It’s like being lost in a maze of legal terms and complex steps. But, there are ways to fight back and protect your inheritance.

Your first step should be to talk to a foreclosure attorney. These lawyers know a lot about stopping foreclosure and can guide you. They’ll explain your rights and help you find ways to save your property.

Bankruptcy is a strong option you can consider. When you file for bankruptcy, an automatic stay stops foreclosure right away. This gives you time to think and plan what to do next.

Another way to fight foreclosure is to question the foreclosure itself. Your lawyer might find mistakes in the foreclosure process or show that the foreclosure was wrong. This could lead to the case being thrown out or a good settlement.

“Knowledge is power. Understanding your legal options can make all the difference in stopping foreclosure on inherited property.”

Remember, time is very important in foreclosure cases. The faster you get legal help, the more options you’ll have. Don’t let fear stop you – take action now to save your inherited property from foreclosure.

Refinancing and Loan Modification Strategies

When you’re facing foreclosure on an inherited property, refinancing and loan modification can help. These options let you change your mortgage terms for better financial health.

Benefits of Refinancing

Refinancing means getting a new mortgage to replace the old one. It can lower your interest rates and monthly payments. This can make managing your inherited property easier.

Loan Modification for Foreclosure Prevention

Loan modification changes your current mortgage without a new loan. It makes your payments more affordable. Lenders might extend your loan term, lower interest rates, or reduce the loan amount.

Eligibility Criteria

To get refinancing or loan modification, you need to meet certain criteria. Lenders look at your credit score, income, and property value. You must show you can handle the new payments. Some programs have special rules, so it’s important to look into them carefully.

“Exploring refinancing and loan modification options can provide the financial relief you need to keep your inherited property and avoid foreclosure.”

Every situation is different. It’s smart to talk to financial advisors or housing counselors. They can help you pick the best strategy for you. They’ll explain the process and the effects of each option.

Selling the Inherited Property to Avoid Foreclosure

If you’re facing foreclosure on an inherited property, selling it might be your best option. This can help you avoid financial strain and potential credit damage. You have several ways to sell the property, each with its own advantages.

A traditional sale through a real estate agent can help you get fair market value for the property. Your agent will guide you through the process, from pricing to closing. They’ll also market the home effectively to attract potential buyers.

If time is of the essence, consider a foreclosure sale. This option might not fetch the highest price, but it can resolve the situation quickly. Remember, speed often comes at the cost of profit in these scenarios.

For underwater mortgages, a short sale could be your lifeline. In this case, you sell the property for less than the outstanding mortgage balance. While this requires lender approval, it can be a good alternative to foreclosure.

“Selling an inherited property in foreclosure is challenging, but it’s often the most practical solution to protect your financial future.”

Before deciding, evaluate the property’s condition. Simple repairs or renovations might significantly boost its appeal and value. Consult with your real estate agent to determine which improvements offer the best return on investment.

Whichever route you choose, act swiftly. The sooner you sell the property, the more control you’ll have over the outcome. Don’t let foreclosure dictate your financial future – take action today.

Conclusion

Inheriting a property in foreclosure can feel overwhelming. But, you have options to stop foreclosure and protect your asset. It’s important to act fast.

Reach out to the mortgage lender quickly to talk about your situation. Look into foreclosure options together.

Legal steps like refinancing or loan changes might help you keep the property. If not, selling the property could be a good idea to avoid foreclosure. Remember, what works for one person might not work for you.

Getting legal advice and making smart financial choices is key. Don’t be afraid to talk to experts who know about inherited property and foreclosure laws. With the right help, you can find a good solution for your property.